Hong Leong Finance offers a variety of savings solutions to suit your specific financial needs and goals. You can find the perfect account to help you achieve your financial aspirations. Each account type comes with its own unique features and benefits, providing you with the flexibility and convenience you deserve on your savings journey. Whether you are a distracted saver or a natural saver, we have an account suitable for you.

Save for your future with a high interest fuss-free savings account. HLF Premium SAVER is designed to make saving simple and hassle-free. You can enjoy high daily interest rates without any additional requirements such as salary crediting, minimum card spend, monthly GIRO, nor minimum monthly account balance fall below fee. With competitive rates across multiple tiers, you have the flexibility to optimise your savings and make your money work harder for you. Start your financial journey with us today and save your future with one of the best savings accounts available.

Features

Attractive daily interest

Enjoy daily interest earnings

No strings attached

Comes with no conditions or limitations

Low initial deposit

Open account with S$500 minimum balance

High Daily Interest Rates

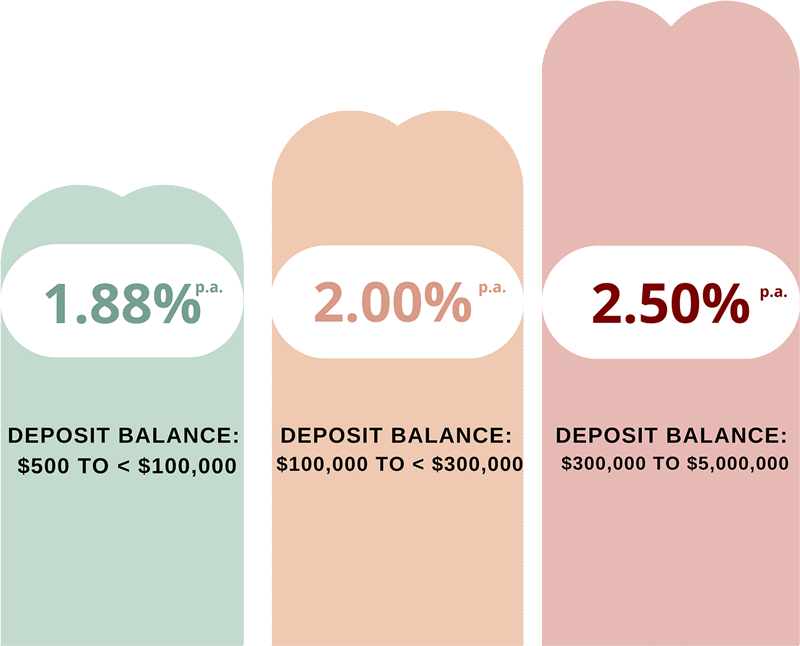

Our savings account interest rate is highly competitive. Experience the advantage of HLF Premium SAVER's multiple daily interest rate tiers and make your hard-earned money work even harder for you. The more you save, the higher the interest rate you'll enjoy.

Tiered Interest Rates

Note: Rates are only indicative and subject to change at any time without prior notice.

No strings attached

HLF Premium SAVER is designed to make saving simple and fuss-free. You can enjoy the attractive interest rates without any additional requirements or hidden costs:

- No Salary Crediting

- No Minimum Card Spend

- No Monthly GIRO

- No Fall-below Fee

Low S$500 Initial Deposit to Start Saving

Begin your savings journey with a low initial deposit sum of S$500 to enjoy the HLF Premium Saver benefits. Take a step closer toward attaining your savings goals today.

Explore the power of our best savings account featuring high interest rates to boost your savings now.

Details

- No fall-below fee

- Easy account opening at any 28 Hong Leong Finance branches

Eligibility

- 15 years old and above

- Singaporeans, Singapore PRs and foreigners

- NRIC/Work Permit/Employment Pass/Student Pass is required

An insured deposit under the Deposit Insurance Scheme. Insured up to S$100K by SDIC.

Terms and Conditions governing deposit accounts.

There is no easier way to earn high interest rate on your savings account than with Fixed Savings Account. Enjoy the convenience of saving with monthly GIRO transfers to your savings account. On top of earning a base interest rate of 0.35% p.a., you will receive additional high bonus interest rate of up to 3.50% p.a. on your savings account. Enjoy one of the best savings accounts in Singapore with no fall below fee, spending requirements or salary crediting!

Features

High Bonus Rate up to 3.50% p.a.

Receive bonus on interest earned upon deposit maturity

Attractive Base Rate up to 0.35% p.a.

Earn more with daily interest on deposit

Simple Conditions

Monthly Giro transfer into account

Details

- Initial deposit of S$100

- Saving through monthly GIRO transfer of between S$200 and S$8,000

- Up to 0.35% p.a. base interest for account balance of between S$300,000 and S$2,000,000.

- Up to 3.50% p.a. bonus interest on saving through monthly GIRO transfers

- Bonus interest is credited on the corresponding GIRO transfer date in January and July

- One account per customer

Eligibility

- 21 years old and above

- Singaporeans, Singapore PRs and foreigners (with valid work permit)

An insured deposit under the Deposit Insurance Scheme. Insured up to S$100K by SDIC.

Terms and Conditions governing deposit accounts.

Interest Rates

| Account Balance1 | S$500 to < 50,000 | S$50,000 to < 300,000 | S$300,000 to ≤ 2,000,000 |

|---|---|---|---|

| Base Interest (p.a.) | 0.15% | 0.30% | 0.35% |

| Giro Transfer Amount For the Month | S$200 to < 1,000 | S$1,000 to < 5,000 | S$5,000 to ≤ 8,000 |

|---|---|---|---|

| Bonus Interest (p.a.) | 3.00% | 3.20% | 3.50% |

- Account balance refers to initial deposit + balance brought forward + Giro transfer amount for the month.

- Base interest is calculated based on account balance x base interest rate / 365 days x the number of days in the month.

- Bonus interest is calculated based on each monthly GIRO amount transfer received x Bonus interest rate / 12 months x the number of months to run before bonus interest payment.

- Rates are indicative and subject to change at any time without prior notice.

Benefits

High bonus interest rate up to 3.50% p.a. with low initial deposit of S$100 and monthly GIRO transfer amount helps you to kick-start your saving journey at your own pace.

No fall below fee, card spending nor purchase of insurance required to enjoy bonus interest.

Monthly GIRO transfer allows you to enjoy more saving at the comfort of your home.

An insured deposit under the Deposit Insurance Scheme.

How Fixed Savings Account Works

Visit the branch to open a Fixed Savings Account with a minimum initial deposit of S$100 and sign-up for monthly GIRO transfer of at least S$200 at the same time.

Receive base interest on account balance at month-end.

Receive bonus interest in Jan in the next year for monthly Giro transfers made for the past 6 months (i.e. July - Dec). Bonus interest cycle repeats in Jul for transfers made for the previous 6 months (i.e. Jan - Jun).

Note: Bonus interest is payable provided the Giro transfers are not withdrawn.

How to Sign Up

Simply visit the nearest branch to open your Fixed Savings Account to enjoy high interest earnings today! Locate our branch here.

Documents Required:

- Bank account details for GIRO transfer

- NRIC (Singaporeans and Singapore PRs)

- Passport and Work Permit (Foreigners*)

- * Either one of the documents below for proof of local address:

- Utility Bill or

- Telephone Bill or

- Bank / Credit Card Statements or

- Rental Agreement

- * Either one of the documents below for proof of local address:

Features

Handy passbook

Keep track of your funds with ease

Daily interest earnings

Earn more with daily interest on deposit

S$100 initial deposit

Open an account with low initial deposit

Details

- Track your money at a glance with a passbook.

- No fall-below fee.

Eligibility

- 15 years old and above.

- Singaporeans, Singapore PRs and foreigners.

- NRIC/Work Permit/Employment Pass/Student Pass is required.

An insured deposit under the Deposit Insurance Scheme. Insured up to S$100K by SDIC.

Terms and Conditions governing deposit accounts.

Interest Rates

| Daily Balance | Interest Rates (% p.a.) |

|---|---|

| S$500 to S$49,999 | 0.100 |

| S$50,000 to S$2,000,000 | 0.150 |

- Rates are only indicative and subject to change at any time without prior notice.